Refinance options for low credit score

The minimum credit score needed to refinance student loans varies by lender but as a general rule of thumb youll likely need a score of about 650 to qualify. USDA loans for low-income buyers in rural and suburban areas.

Should I Refinance My Mortgage Infographic Paying Off Mortgage Faster Mortgage Interest Rates Mortgage Amortization Calculator

VA loans a.

. These may include lender fees homeowner insurance premiums and other costs. The lowest credit score would be used for qualification purposes. Trusted by 2 million home loan borrowers to date.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. Fewer options for bad credit. The minimum credit score you need for a cash-out refinance is typically 620.

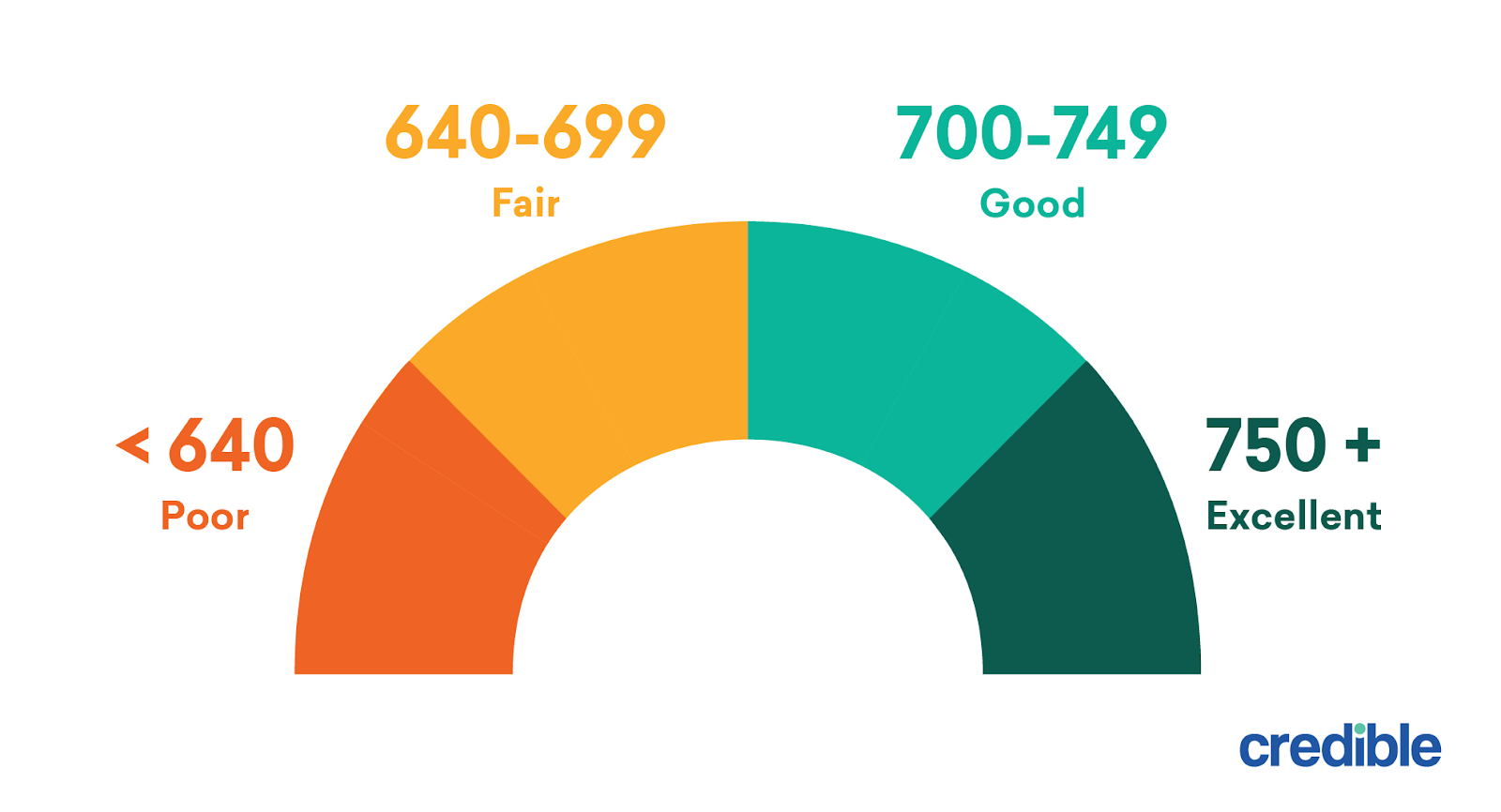

Heres the average interest rate by credit level for a 30-year fixed-rate mortgage of. Credit scores Although the USDA doesnt require a full credit review we will probably check your credit score which may inform the interest rate we offer you. What is a credit score.

Ways to build your credit score with a personal loan You can use a personal loan to build your credit rating in several ways. Closing costs As with any loan refinancing closing costs apply. Your LTV ratio determines the minimum credit score required for a rate-and-term refinance on a mortgage backed by the Federal Housing Administration.

Consult your licensed loan officer regarding the lending institutions credit requirements in such cases. A few popular options include. This financial situation resulted in an interest rate of 1688 for a subprime borrower on a used carhigher than the national average of 949 for used cars.

The no-money-down USDA loan program typically requires a credit score of at least 640. Citizens lines of credit begin at 5000 with its GoalBuilder HELOC and 17500 with its standard HELOC. Many lenders offer auto loan refinance options allowing you to shop around to increase your odds of getting a low rate.

The minimum credit score is 500 for borrowers with a maximum 90 LTV. FHA Refinance Options for Homeowners. Theres no industry-set minimum credit score to buy a house but Rocket Mortgage requires a credit score of at least 580 for a VA loan.

Credit score requirements can also vary by. Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more. The good news is there are other options to consider before reaching this point as outlined above.

However borrowers with credit scores as low as 500 but with home. Additionally you might not qualify for the best interest rates if you have less-than-perfect credit. Mortgage rates valid as of 31 Aug 2022 0919 am.

By Gabrielle Olya. Interest rates are near all-time lows. With the minimum credit score to refinance of 580.

Why Citizens is the best home equity line of credit for low loan amounts. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. At the time Sam had a low income and credit score plus a fair amount of debt.

Your credit score will take a serious hit in the case of a foreclosure up to a 160-point drop according to FICO and sticks with you for up to seven years. 11 Best Stocks for Trading Options in 2022. Your credit score is a number that represents a snapshot of your credit history that lenders use to help determine how likely you are to repay a loan in the future.

Network of lenders compete for your loan. But you must be a. If you make a down payment of less than 25 you typically need a credit score of at least 680 and low debts or 720 with a higher debt-to-income ratio.

FHA loans allow low income and as little as 35 percent down with a 580 credit score. Data from credit scoring company FICO shows that the lower your credit score the more youll pay for credit. Cons There are no extra rewards programs that come with.

Your debt-to-income DTI ratio is the amount you owe in debt payments each month compared. The higher the credit score the better a borrower looks to. By Jami Farkas.

In a typical scoring model your score generally ranges from a low of 300 to a high of 850. Eligibility requirements Your vehicle must be no more than 10 years old and have fewer than 150000 miles. The average interest rate for a 30-year mortgage has broken 6 a level it hasnt hit since 2008 reaching 612 this week.

6 Hidden Ways To Help You Boost Your Credit Score. Let Bankrate a leader. FHA loans are the 1.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. USDA Loan Requirements You could look into a government-backed USDA loan if you plan to live in a qualified rural or suburban area and have an income that falls below 115 of the areas median income. The most popular options are generally debt consolidation loans and.

If you fail to make payments your lender repossesses the home. If you have poor or fair credit it could be harder for you to get approved for refinancing. Another no-money-down mortgage the VA loan allows credit scores as low as 580-620.

The best online banks combine service and low fees. That could change after the Federal Reserve raises its interest rate. FHA Streamline Refinance Loans.

Lending platform RateGenius is an online platform that partners with more than 150 lenders to provide refinance offers to people who qualify for a loan. While you may not qualify for a low rate right now you can refinance your loan at a later date once your credit and financial situation has improved. Refinance your auto loan.

Depending on your credit this card could have fairly low ongoing 1424 - 2424 variable APR compared to other balance transfer cards. Keep in mind that this lender may offer different. Since purchasing the car Sams income has risen his debt has shrunk and his credit score has improved.

Get 4 free refinance quotes in 30 seconds. Plus your existing auto loan must have a balance of at least 10250. Low 35 Down Payment Requirements Credit Score Requirements as Low as 580.

Best Prepaid Credit Cards To Build Credit. The minimum credit score is 580 for borrowers with a maximum 9775 LTV ratio. However FHA and VA cash-out refinance loans might allow a slightly lower credit score.

FHA refinances are possible if your credit score is as low as the mid-500s. Options for home purchase or refinance. A decade ago low-credit-score loans were harder to get but the credit markets have loosened considerably since then.

Minimum credit score needed.

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

Refinance With Fha Loan Program Loan Saver Direct Fha Loans Fha Savers

640 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What C Loans For Bad Credit Bad Credit Mortgage Credit Score

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Fha Mortgage Credit Score Mortgage Loans

Pin On Economy Infographics

Debt Refinancing New Challenges For More Tips Go To Www Therightmortgage4u Ca Money Frugal Che Pay Off Mortgage Early Mortgage Payoff Refinance Mortgage

Can I Refinance My Mortgage With Bad Credit Nerdwallet

Can You Get A Mortgage With Bad Credit Bad Credit Mortgage No Credit Loans Bad Credit Score

How To Get A Bad Credit Home Loan Lendingtree

5 Tips For Refinancing As Mortgage Rates Rise Mortgage Rates Refinancing Mortgage Mortgage

Cash Out Refinance With 500 Credit Score How To Get Approved Cash Out Refinance Home Buying Tips Cash Out

Ways To Get The Best Refinance Rates Mortgage Net Money Lessons Money Saving Strategies Saving Money Budget

Benefits Of Buying A Home With A Va Mortgage Loan

Tumblr Mortgage Loan Originator Refinance Mortgage Mortgage Loan Calculator

Should I Refinance My Mortgage Learn If Mortgage Refinancing Is Right For You

What Is A Good Credit Score To Buy A House Or Refinance